Queensland Gaming Data

Queensland Gaming Data

QLD March 2024 Gaming Results

Queensland Metered Win for March 2024 ($283.6M) has shown a 7.91% increase on last year (March 2023 – $262.8M). When compared against last month (February 2024), there was an increase of 6.66% largely due more trading days in the month. ADR for Queensland was $235.

Justine’s Take on March’s Gaming Results

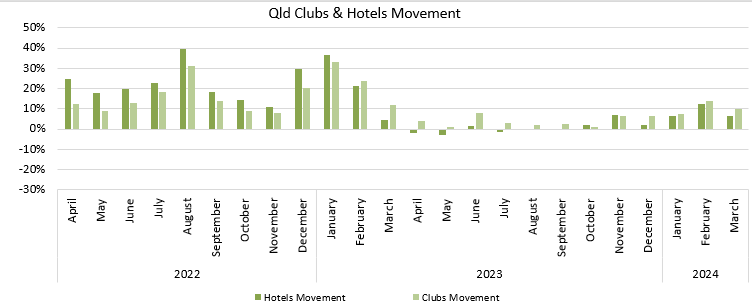

Clubs and Pubs in QLD, and across many LGAs, saw a very positive March result in 2024 with a solid increase in metered win in Clubs of 10.09% and Pubs of 6.25% when compared to last year. The advantage of an early March Easter is clear (considering Easter fell into April last year), but we may see this impact next April’s results and balance out the two months.

I’m seeing data to confirm that much of the positive lift in venues has come from a range of popular new links that have continued to be released by all manufacturers over the last year. Links in both Clubs and Pubs in QLD are still the strongest products, both in number, and based on performance, hence it is vital to keep up to date with new links, and new link games, as they become available.

As the return to house percentage is higher on links, (i.e. they give back more to the players), they must sit above your turnover floor average to ensure a good revenue return. If they are below average, you need to reduce the numbers through trading some out, convert some of the least popular games on the link, or convert them off the link and back to SAP games.

Let’s use April as the month to revisit where our link performance levels really are and develop a plan of action to improve their performance.

Regional Analysis

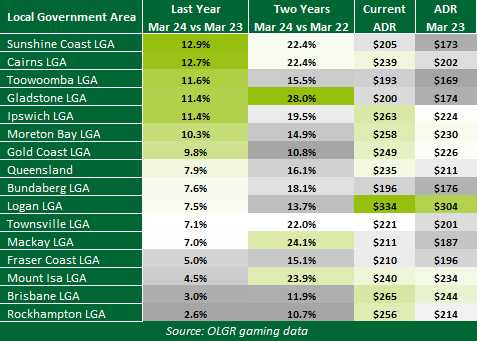

The majority of LGAs have shown significant increases on March 2023 results, but increases are not as high as last month. Sunshine Coast had the highest increase at 12.9%, followed by Cairns (12.7%) and Toowoomba (11.6%). In ADR Logan, Brisbane and Ipswich were the highest performers.

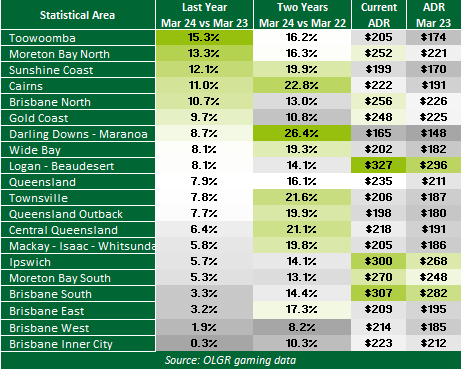

Increases in SA4 data also shows the highest increases in Toowoomba (15.3%) and Moreton Bay North (13.3%), with Sunshine Coast rounding out the top three at 12.1%. Logan-Beaudesert earned the highest ADR at $327, followed by Brisbane South at $307 and Ipswich at $300.

MARCH CLUBS AND HOTELS ANALYSIS

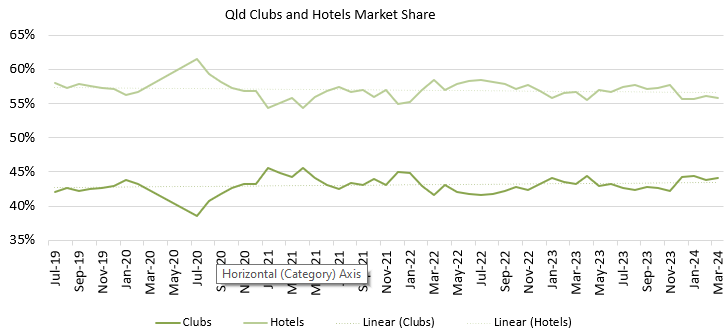

Clubs saw an increase to market share at 44.2%, taking Hotels’ market share down to 55.8%.

Year on year movement of metered win by Clubs and Hotels across Queensland shows Clubs have seen an increase of 6.3% on March 2023, with Hotels MW increasing by 10%.

How do you compare to your region’s performance?

For further information contact the DWS team on (07) 3878 9355 or email info@dws.net.au.