There is so much talk, theories, reports, and misinformation about the potential impact of the new Brisbane casino on the Queensland Club and Hotel industry, it’s difficult for anyone to get a clear understanding of what the impact may be. DWS have been monitoring and reporting on gaming in the Queensland gaming industry for well over twenty years, coupled with DWS’s intimate involvement in the management of the Queensland Club and Hotel industry through feasibility studies and strategic planning for over twenty-five years. In addition to the above, DWS publish a monthly analytical gaming report supplied to the industry and newsletter subscribers.

However, access to credible and accurate information as to how the casino will operate in regards to gaming when it opens mid next year, is not so easy to gain. In January 2020 Darren Cartwright wrote in the Courier Mail that Brisbane’s new casino will be an Armageddon for the Queensland Club industry, quoting that the “end effect will be up to $17 million dollars less to be distributed to Queensland sporting organisations and charities”. Allowing for inflation, that figure today on Darren Cartwright’s formula could be in the order of $25 million.

The latest Synergies report (commissioned by Clubs Queensland) indicated that the reduction in community contributions by the Club industry could be in the order of $8.36 million, significantly less than Darren Cartwright’s assumption. The variance in these two assumptions highlights the uncertainty of the casino’s potential impact.

To add to the debate, DWS have endeavoured to calculate its assumptions on the impact of the casino on the Club and Hotel gaming industry by looking at the business case of the Casino’s $3.5 billion plus investment and what their expected returns may be over time. The Australian casino gaming market has changed dramatically since the initial feasibilities were produced for the new Brisbane casino. What must be considered is the significant loss of the overseas gaming market (especially the junkets or whales) coupled with the significant increase in regulator’s compliance restrictions and corporate governance oversight following the casino enquiries in both Victoria and New South Wales. As demonstrated in the Queensland Casino Control and Other Legislation Amendment Bill of 2023, will significantly impact on the original projected revenues for the Brisbane casino. This will further the casino’s focus on the Queensland domestic market to increase market share at a cost to Queensland community Clubs and Hotels.

If any further evidence was needed as to how aggressive the casino will need to be in the Queensland domestic market, you need look no further than the Star Entertainment Group 2023 Annual Report which reported the statutory net loss after tax of $2.4bn. Pairing this with what would be the normal expected commercial returns on a $3.5 billion business investment of an estimated 5%, would equate to $175 million.

According to the Brisbane casino’s website, it currently operates 1300+ EGM’s (less than the original approval). For reference, the new casino is licensed for 2500 EGM’s; but how many additional EGM’s the new casino will add to its floor is unknown. Also unknown is the casinos EGM’s average daily revenue (ADR). Two pieces of information that would be needed by anyone to endeavour to estimate loss to the Queensland Club and Hotel EGM market.

On the evidence that is available, certain assumptions could be made further to the Synergies report or Darren Cartwright’s article.

If we use the estimated investment return of $175 million per annum plus an additional $175 million to make up some losses, we could assume that the additional profit the casino may be looking for could be in the order of $350 million.

We could also further assume that 60% of that return would come from the casinos EGMs, equating to approximately $210 million.

Does this assumption Add Up?

If we further assume that the casino nets 10% from EGM turnover, that would equate to a turnover of over $2 billion that the casino would need attract from the Queensland domestic market. Approximately half of gaming revenue comes from Hotels and half from Community Clubs. Given that 75% of the club market is located in the south-east corner of the state, we can predict that Clubs in the south-east corner could lose up to $562 million under this equation.

What do you think?

There are approximately 13,200 operational EGMs in the Queensland south-east corner, under this scenario each Club EGM in the south-east corner could be down approximately $42.500 per annum. For the month of October 2023, the club industry ADR average was $186.00, or $1,600 turnover per day per EGM. For a 150 EGM site, this would result in an annual gaming turnover loss of approximately $6.4 million against an average gaming turnover of $86 million. In other words, approximately a 7.5% drop in gaming turnover.

For anyone to suggest that the casino will have little to no impact on the Queensland Club and hotel industry would be naïve, and it couldn’t come at a worse time. If gaming trends emerging in NSW due to the economic downturn are reflected in Queensland in 2024, then there is a cause for concern for the SEQ market.

To quote Justine Channing, editor of the Drop Magazine, “some NSW Clubs are 15% down in gaming.”

Do you agree with our predictions? Let us know your thoughts and if you are predicting a bigger or smaller impact on the industry?

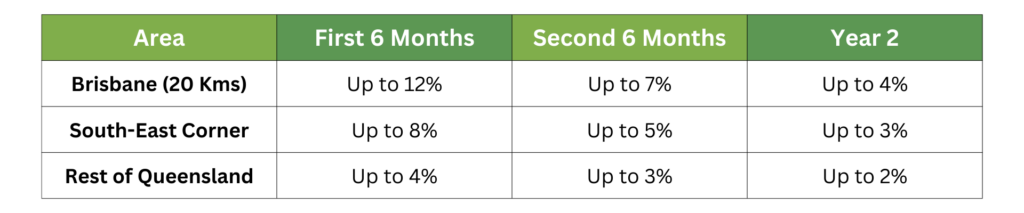

Forecasted Gaming Loss Metrics